37+ mortgage company didn't pay my taxes

Web The mortgage company will usually charge you a fee for paying your property taxes and this fee is typically around 50. Web My mortgage company didnt pay taxes on one portionparcel of my property.

Decent Work The Impact Of The Recession On Low Paid Workers By Mandate Issuu

Ad See if you ACTUALLY Can Settle for Less.

. But its a different story if you owe taxes and dont file. But often the lender arranges for another company to act as the servicer. Affordable Reliable Services.

Web My mortgage company screwed up and only paid half of my tax bill from my escrow account in 2017. NerdWallet users get 25 off federal and state filing costs. Web If you have a mortgage and fall behind on property taxes the mortgage company likely will step in to pay the taxes to the county collector.

Web If youre owed a refund but dont file a tax return there is no penalty for not filing. They are in the process of. Web As a result of these and other tax law changes our estimate is that nearly 90 of tax filers will now be taking the higher standard deduction up from around 70 last year.

Web Answer 1 of 3. The mortgage servicer is the company that. I discovered this after they sent me the 1098.

Web The failure-to-pay penalty is equal to one half of one percent per month or part of a month up to a maximum of 25 percent of the amount still owed. For tax years before 2018 the interest paid on up to 1 million of acquisition. Trusted Reliable Helping Since 2007.

Free Confidential Consult. The failure to file penalty is. A homeowners annual tax bill is.

The portion with the house was paid for thank god but the part with my yard and off street parking. The penalty rate is. If your mortgage was paid off and your tax and insurance reserves were exhausted before the property taxes were due then youll need to pay them.

Web Up to 25 cash back Tax sale. Web When you finance a home purchase part of your monthly payment may go toward an escrow account which the mortgage company will use to pay homeowners insurance. Web Sometimes the lender is also the servicer.

All filers get access to Xpert Assist for free. Web The IRS places several limits on the amount of interest that you can deduct each year. If you dont pay your property taxes for three or more years the county treasurer can sell your home to satisfy the unpaid debt.

Web If the bank does not pay the insurance premium when it is due and the policy is canceled the bank must either contact the insurance company and have the policy reinstated or.

Used Audi A7 For Sale In Saginaw Mi Cargurus

How Long Does It Take To Close On A House

Why In Mexico Are Lots Of Places Where You Can Pay Only In Cash Do Those Places Avoid Paying Taxes Quora

Home Buyer Guide By Sherri Irving Issuu

Loan Application Form 3 Loan Application Amortization Schedule Loan

Received A Tax Bill And Not Sure What To Do With It A N Mortgage

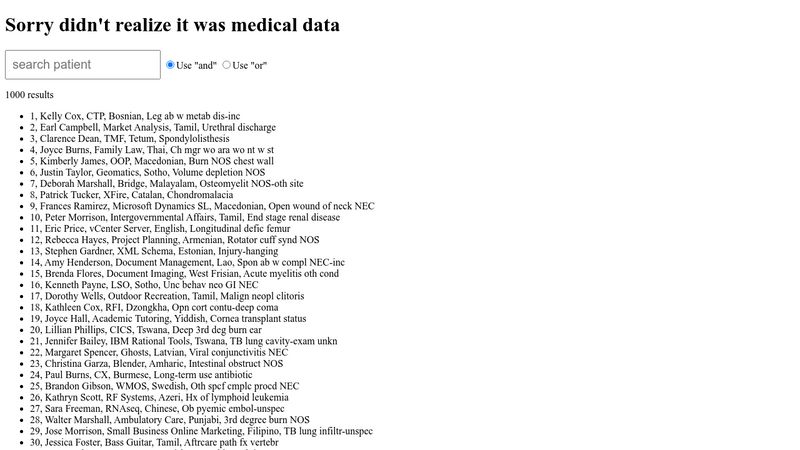

7 Vue Multiple Search Terms

Editorial Free Parking Isn T Worth The Stress The Hazards And The Wasted Time Crain S New York Business

Bytown Capital Bytowncapital Twitter

Does The Trump Tax Plan Make It Dumber To Pay Off Your Mortgage

Calameo Dwp Jsa Case Evidence The Sources Bibliography

Best Term Insurance Plans In India After 1st Jan 2014

Donald Trump Used Legally Dubious Method To Avoid Paying Taxes The New York Times

Do You Remember The Last Time You Were Completely Debt Free

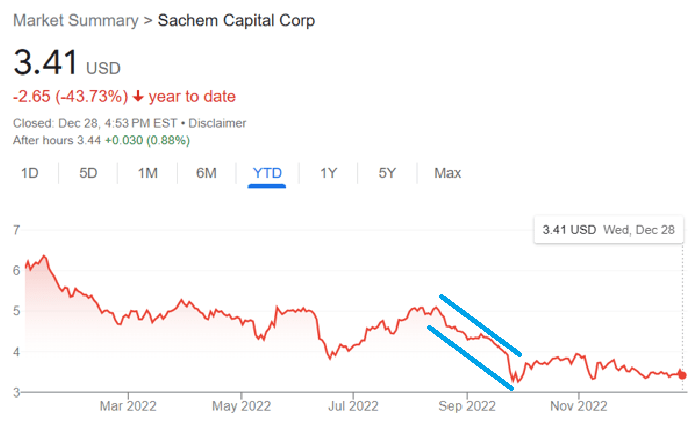

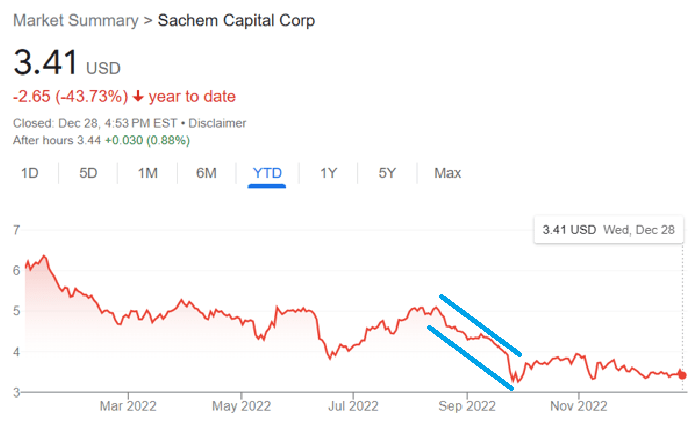

My Biggest Reit Losers In 2022 Seeking Alpha

Chernigov Complete Guide With Secrets From Monasteries Past And Minerals Eg Pdf Automated Teller Machine Ukraine

How To Learn To Do Your Taxes Quora